Key Drivers of Growth

Market Performance: Positive market trends and favorable economic conditions played a crucial role in boosting asset values.

Client Acquisition: Enhanced marketing and client engagement strategies resulted in a broader client base.

Investment Strategies: Diversification and strategic investment approaches led to higher returns and asset accumulation.

Technological Advancements: The adoption of advanced technologies improved service delivery and client experience, contributing to asset growth.

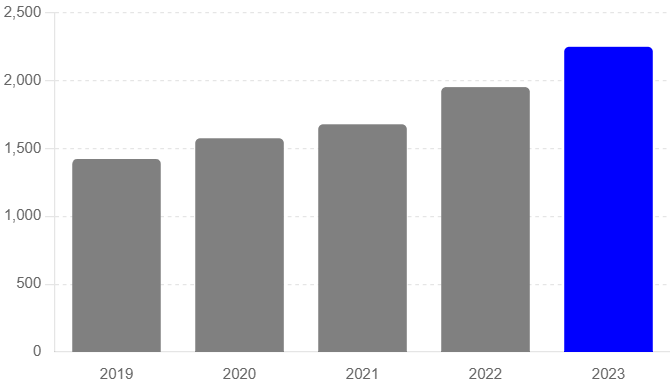

Growth in Client Assets in Billions

Analysis of Growth Trends

2019-2020: Steady Growth In 2019, the total client assets were valued at NOK 1,423 billion. This figure saw a notable increase in 2020, rising to NOK 1,575 billion. The 10.7% growth can be attributed to improved market conditions and a surge in client investments, reflecting growing confidence in the financial markets.

2020-2021: Continued Expansion The upward trajectory continued in 2021, with total assets reaching NOK 1,678 billion. The growth rate of 6.5% highlights the continued expansion and the resilience of financial services amidst global uncertainties.

2021-2022: Significant Surge The year 2022 witnessed a significant surge, with client assets climbing to NOK 1,952 billion. This 16.3% increase can be linked to strategic investment decisions, diversification of portfolios, and enhanced client acquisition strategies.

2022-2023: Peak Growth The peak of this growth period was observed in 2023, with total client assets soaring to NOK 2,249 billion. This 15.2% rise underscores the effectiveness of innovative financial products, increased client engagement, and favorable economic conditions.

Our Client Assets from 2019 to 2023

The financial landscape has seen substantial growth in client assets over the past five years. This period, spanning from 2019 to 2023, has marked a significant upward trend, reflecting the robust performance and increasing trust in financial management services. Here, we provide a detailed overview of this growth trajectory, highlighting key figures and insights.

Future Outlook

The consistent growth in client assets from 2019 to 2023 sets a promising foundation for future expansion. Moving forward, financial institutions aim to leverage technology, refine investment strategies, and enhance client relationships to sustain and accelerate this growth trajectory. The focus will remain on delivering value, optimizing returns, and ensuring client satisfaction in an increasingly dynamic financial environment.

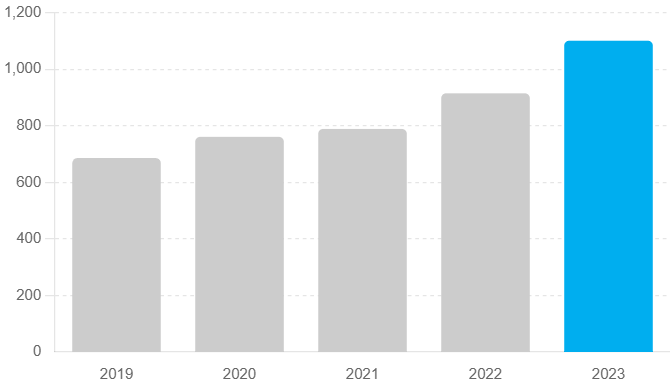

Assets Under an Advisory Relationship

Key Drivers of Growth

From 2019 to 2023, client assets under advisory relationships in the financial sector have significantly increased, indicating a strong trend towards professional financial management and advice. This growth underscores a growing trust in financial advisors and an expanding market for advisory services.

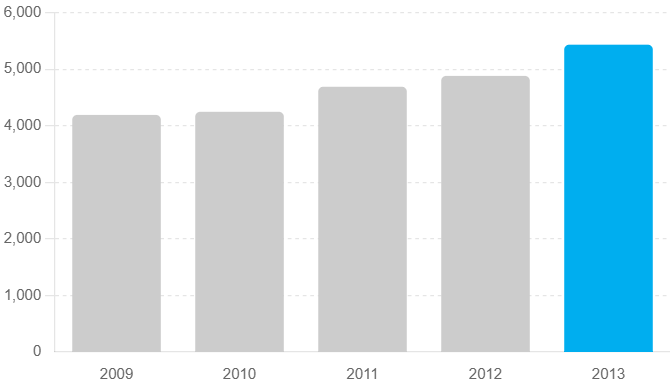

Net Revenues_(In Millions of Norwegian Kroner)

Analysis of Growth Trends

2009-2010: Modest Growth In 2009, the net revenues stood at 4,000 million NOK. This figure increased modestly to 4,100 million NOK in 2010. The 2.5% growth reflects the initial recovery phase post the global financial crisis, where companies began stabilizing and regaining revenue momentum.

2010-2011: Continued Expansion The net revenues saw a more pronounced growth in 2011, rising to 4,300 million NOK. This 4.9% increase is indicative of the continued expansion and recovery efforts, with businesses focusing on enhancing their revenue streams through diversified services and improved operational efficiencies.

2011-2012: Significant Growth The year 2012 marked a significant increase in net revenues, reaching 4,800 million NOK. The 11.6% growth underscores the success of strategic initiatives aimed at boosting revenue, including the introduction of new products and services, as well as entering new markets.

2012-2013: Peak Growth The peak of this growth period was observed in 2013, with net revenues soaring to 5,300 million NOK. This 10.4% increase highlights the effectiveness of the financial sector’s strategies in driving revenue growth, supported by favorable economic conditions and increased client engagement.

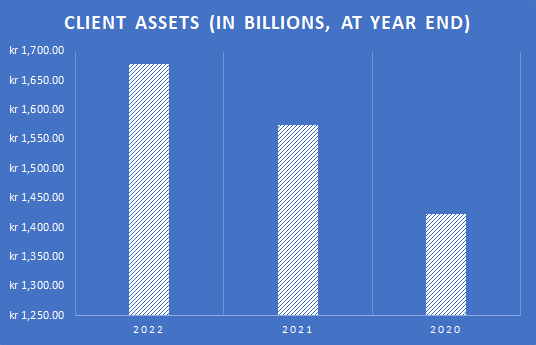

GROWTH RATE 1-Year |

||||

|---|---|---|---|---|

| Year Ended December 31, | 2022-2023 | 2023 | 2022 | 2021 |

| Client Activity Metrics:

Client assets (in billions, at year end) |

7.00% 13.0t0% |

kr 1,677.70 kr 451.10 |

kr 1,574.50 kr 399.70 |

kr 1,422.60 kr 414.80 |

| Company Financial Metrics:

Net revenues Expenses excluding interest |

10.00% -5.00% |

kr 4,691.00 kr 451.10 |

kr 4,248.00 kr 399.70 |

kr 4,193.00 kr 414.80 |

| Income before taxes on income Taxes on income |

79.00% 62.00% |

kr 1,391.00 – kr 528.00 |

kr 779.00 – kr 325.00 |

kr 1,276.00 – kr 489.00 |

| Net income | 90.00% | kr 864.00 | kr 454.00 | kr 787.00 |

| Earnings per share – diluted Net revenue growth (decline) from prior year Pre-tax profit margin Return on stockholders’ equity Net revenue per average full-time equivalent employee (in thousands) |

84.00%

4.00% |

kr 0.70 10.00% 29.70% 12.00% kr 350.00 |

kr 0.38 1.00% 18.30% 8.00% kr 337.00 |

kr 0.68 -19.00% 30.40% 17.00% kr 338.00 |

PSS provides financial services to individuals and institutional clients through two segments – Investor Services and Institutional Services. The Investor Services segment provides retail brokerage and banking services to individual investors. The Institutional Services segment provides custodial, trading, and support services to independent investment advisors (IAs). The Institutional Services segment also provides retirement plan services, specialty brokerage services, and mutual fund clearing services. For financial information by segment for the three years ended December 31, 2023. Segment Information.” As of December 31, 2023, PSS had full-time, part-time and temporary employees, and persons employed on a contract basis that represented the equivalent of about 14,100 full-time employees.

Our Story

The arrival of the 21st century has seen the financial service industry change almost beyond recognition through innovations in information technology. The world has ‘shrunk’ and demand for less-centralized financial services is increasing rapidly.

PSS opened its doors as PSS Trust and Credit Corp. disrupting the industry ever since through removal of the cost barrier, making investing accessible, understandable, and financially rewarding for everyone. Innovation has been at the core of everything we do.

Today, we continue to look for ways to make a meaningful impact in the industry and beyond. We believe in our collective power to transform lives and invest for the better.

OUR PURPOSE

PSS exists to transform lives through investing for the better. This purpose and rallying cry guide everything we do, say, and embody. It gives us a clear sense of responsibility and direction.

We leverage our assets, scale, and people for the greater good. By fulfilling our purpose, we can positively transform lives and communities.

We focus on sustainable and impactful investments that benefit society. Our commitment to this mission drives us to continuously innovate and improve. In doing so, we aim to make a real and lasting impact in the world.

OUR VALUE

People Matter

We treat others with courtesy, dignity, respect, and have a high regard for diversity. We help each other and our communities to grow and succeed.

Client Driven

We listen to each client and are empowered to

deliver solutions that best fit their individual and unique needs. We aspire to deliver client experiences and interactions we are proud to stand behind.

Meaningful Innovation

We actively challenge the status quo with creative thinking while embracing new methods, tools, and technologies. We take smart, calculated risks based on disciplined thinking and judgment. We welcome change as a means to a better way.

our ceo is back

Yes, Joseph J. Deiss is back. That’s news. But we’ve done more than just bring back a CEO. We’ve brought back what made PSS successful in the first place.

THINGS ARE DIFFERENT NOW

Refocusing on our core franchise and exiting banking sector, simplifying and streamlining our organization and client offerings, and improving our value propositions.

2023 Annual Report is in

See our latest earnings, cash flows, and acquisitions.

Our Annual Revenues Growth

get in touch

- Call, email 24/7 or visit a branch

- + 46 10 337 14 61

- helpdesk@pssinvest.com

Be sure to make appointment before you visit our branch for online trading service as not all branches have a financial service specialist.