During 2023, PSS continued to

make progress alongside our

operating priorities

Diversified client acquisition

In 2023, PSS grew organically by attracting new clients to PSS’s two primary business segments, Investor Services, and Institutional Services. Investor Services added 163,221 households, helping to boost the number of active brokerage accounts to 8.6 million and the number of banking accounts to 780,000. Among the many initiatives designed to acquire new clients were the relaunch of the marketing website at pssinvest.com. In Institutional Services, PSS gained new clients in two important segments — Independent Investment Advisors and company plan sponsors.

Win-Win monetization

In 2023, PSS’s diversified revenue streams helped generate profitable growth. Asset management and administration fees—our largest single source of revenue — grew 6 percent year-over-year, from kr1.8 billion to kr1.9 billion in 2023. A number of strategies fueled this growth:

- We expanded client investment solutions, including new index exchange-traded funds (ETFs), fixed income, and global investing capabilities. Our fast-growing family of ETFs reached kr 5.0 billion in assets just two years after the initial ETF launch.

- Our clients enrolled in fee-based advisory solutions in increasing numbers. On average, approximately 4,000 clients per month choose to move from do-it-yourself to PSS advisory solutions.

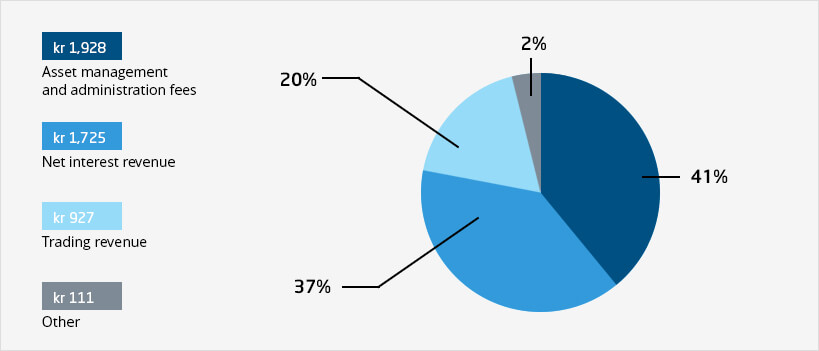

2023 net revenues (In millions)

Net interest revenue continues to be important, even though much of the revenue benefit is currently masked as a result of the ultra-low interest rate environment. In 2023, client cash assets invested on PSS’s balance sheet grew by 19 percent, from kr 81.1 billion at the beginning of 2023 to kr 96.4 billion by year-end. Trading remains a relatively modest part of PSS’s revenue mix, contributing only 20 percent of revenue, but it is important to any brokerage firm. At the height of stock market volatility last March, PSS experienced four of the top trading days in the firm’s history and processed more than 1 million trades on a single day. Maintaining that capacity — and reliability — ensures that the company will be there when clients need us most. In Advisor Services, we completed the first phase of PSS Intelligent Integration™, a ground-breaking platform that will enhance the productivity of thousands of independent advisor arms.

THINGS ARE DIFFERENT NOW

PSS’ reputation and the commitment it shows to its customers through its services and business decisions are the best way to judge its financial integrity. Hence, sustaining the security of your money is a top priority of PSS.

THINGS ARE DIFFERENT NOW

PSS’ reputation and the commitment it shows to its customers through its services and business decisions are the best way to judge its financial integrity. Hence, sustaining the security of your money is a top priority of PSS.

get in touch

- Call, email 24/7 or visit a branch

- + 47 80 02 48 83

- helpdesk@pssinvest.com

Be sure to make appointment before you visit our branch for online trading service as not all branches have a financial service specialist.