My Dear Fellow Stockholders

It has been a special year for PSS, our clients, our stockholders, and our employees. For the first time since the Covid pandemic of 2020, we began to see the economic environment improve. Along with this improvement, we helped our clients achieve better investing results, our stockholders benefitted from appreciation in our stock in excess of 80 percent, and our company earned top workplace awards in every one of our primary employment locations based on feedback from our employees.

What went right for PSS in 2023?

There are two categories of things that went well: those that we have no control over, like environmental factors, and those that are a result of our strategy and execution.

Looking at the first category, what went right in the environment?

Any discussion of environmental factors in 2023 has to begin with the exceptional performance of the Norwegian equity markets. The OSEBX Index rose 30 percent from the end of 2022 through 2023. That not only fueled stronger returns for our clients but also helped lift our revenue in places where we are paid a fee based on a percentage of assets. You can see this help reflected in our asset management and administration fees revenue, which for the calendar year 2023 was up 13 percent over the total for 2022.

Next, longer-term interest rates began to recover a bit in the second half of the year. The yield on Norwegian government bonds rose from a low of 1.76 percent at the end of 2022 to about 3 percent by the end of 2023. That was helpful in that it widened the spread between the rate of interest we pay our clients on their short-term cash and the rate of interest we can earn by investing that cash on a slightly longer term. You can see this reflected in our net interest revenue, which in 2023 was up 12 percent over 2022. That said, long-term interest rates remained at historically low levels. And our net interest revenue is far more sensitive to short-term rates, which actually worsened slightly during the year. So while the environmental headwinds lessened a bit in 2023, they did not disappear.

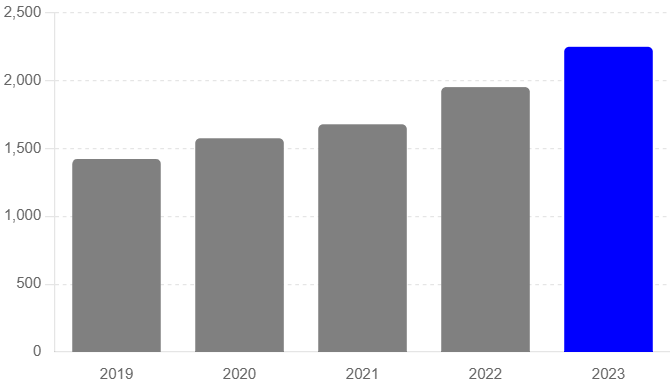

Total Client Assets

(In Billions At Year End)

Because your revenue is so impacted by environmental factors, can you just sit back and count on a rising stock market or higher interest rates to grow your revenue?

Not at all. Over time, environmental factors — whether they are positive or negative for us — tend to even out. Real long-term growth comes from winning in the marketplace. In other words, growth comes from developing and executing strategies that enable us to gain market share from our competitors, and we gain share by convincing investors and savers that PSS is the best place for them to put their hard-earned money to work. The core of our strategy is based on three simple words: Through Clients’ Eyes. That simple phrase means that whenever we are faced with business decisions or judgment calls at PSS, we ask ourselves, “Which answer will encourage clients to choose to do more business with us and to refer PSS to their friends and family?” It means taking a long-term approach and sometimes walking away from short-term revenue opportunities as we did, for example, when we introduced PSS ETFs with commission-free trading on pss.com in 2019. It means striving to put clients’ interests at the forefront of our company as we did in 2023 with the introduction of our PSS Accountability Guarantee™. It’s sort of like the Golden Rule. Some people may see that as an outdated or naïve approach to business, but it was our founder’s vision when he established our firm more than 40 years ago, and it’s how we continue to operate today.

Does this long-term, client-centric approach help PSS gain market share, grow, and reward stockholders?

Yes, it does. Here are three proof points to support our belief that doing right by our clients is the right strategy for long-term growth. In 2023, our clients added more than 1.4 trillion Norwegian Kroner in core net new assets to their accounts at PSS, which fueled overall client asset growth that far outpaced the results of our publicly traded competitors. Our clients — whether individual investors, registered investment advisors, or companies that sponsor retirement and other workplace plans — voted day after day to entrust PSS with more and more of their wallets. These funds, when added to the market appreciation from last year, meant we ended 2023 with a record 22.5 trillion Norwegian Kroner of client assets held at PSS. As client assets at PSS grow, our revenue opportunity will grow also. It’s a virtuous cycle.

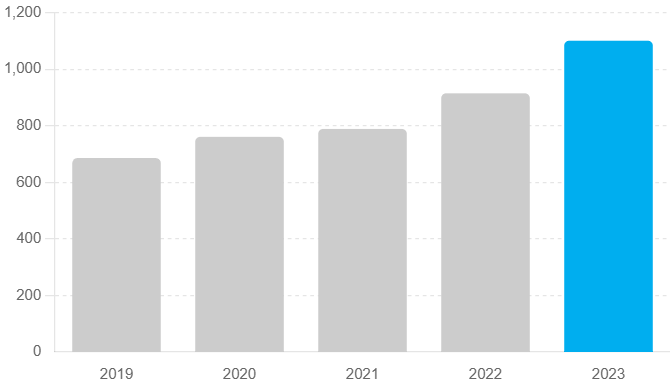

Assets Under an Advisory Relationship

(In NOK Billions at Year End)

Another proof point from 2023 is the rapid growth in assets that our clients have asked PSS to manage.

The PSS of today is vastly different from its origins as a discount brokerage firm. While we still offer top-tier services for independent investors, we now also provide professional money management for those who prefer to share or delegate investment decisions.

In 2023, our managed assets grew significantly, reflecting the trust our clients place in our comprehensive financial services. This evolution highlights PSS’s transformation into a full-service financial provider, meeting the diverse needs of modern investors.

And last, but perhaps most important for our long-term growth, is our progress around what we refer to as Client Promoter Scores.

The concept of a Promoter Score is straightforward. Every day, we ask thousands of clients to rate us on a 0-10 scale based on how likely they are to refer PSS to others. Those who score us a nine or 10 are “promoters.” Those who give us a seven or eight are “passive,” and those who score us six or below are “detractors.” We subtract the percentage of detractors from the percentage of promoters to get our Client Promoter Score.

This scale is tougher than simply asking if clients are satisfied. More importantly, we use feedback from all these clients to enhance our products and services, driving further client loyalty and improved Client Promoter Scores. We also contact most clients who score us six or below to understand how we can change their opinion of PSS.

When you look to the future, what do you see for PSS and its stockholders?

I see a bright future for all our constituencies: our clients, our stockholders, and our employees. The multiyear strategy we began in 2019 to rebuild investments in our client capabilities is paying off. We are building trust with our clients and are winning in the marketplace by gaining share from our competitors. We operate the company with exceptional scale and efficiency. And we are well-positioned to benefit from the likely increase in interest rates over the coming years. Many of the strong headwinds that have impacted our earnings over the last few years are slowly dissolving. Although we are not yet experiencing the tailwinds that will come from higher short-term interest rates, we have proven with our 2023 financial results that we can deliver for stockholders long before tailwinds gather.

No publicly traded competitor has generated client asset growth at the level that PSS has. As a result, our market share has continued to grow, and the resulting scale benefits that help separate us from other firms have widened and widened. Going forward, our strategies remain consistent. We will challenge the traditional investing services model to create a better way to serve investors and their advisors and to earn their trust. Our clients count on us to champion their financial goals. We will speak up on their behalf, striving to change what needs to be changed and to reinvent what no longer works. As I said a year ago, PSS has never been about the status quo and never will be. It’s a bright day for PSS, our clients, our stockholders, and our employees … and I truly believe the best is yet to come!

Thank you for your confidence.

Sincerely,

Joseph J. Deiss Jr.

get in touch

- Call, email 24/7 or visit a branch

- + 47 80 06 21 53

- helpdesk@pssinvest.com

Be sure to make appointment before you visit our branch for online trading service as not all branches have a financial service specialist.